SAP (Systems, Applications, and Products in Data Processing) is a leading enterprise resource planning (ERP) software that helps businesses manage their operations efficiently. It integrates various business functions such as finance, supply chain, human resources, and more, enabling organizations to achieve better decision-making and operational excellence.

Learn from industry professionals with real-world SAP experience.

Work on live projects and real-time case studies.

Work on real-time SAP HANA administration projects.

Online and classroom training options available.

Get guidance for SAP FICO certification exams.

Resume building, interview preparation, and career assistance.

Emax Technologies empowers learners with industry-relevant skills, leading to career advancements, better job opportunities, and higher salary growth.

Our SAP FICO training course is designed to provide comprehensive knowledge of financial

accounting and controlling within the SAP ERP system. Whether you are a beginner or an experienced professional, this course will help you gain in-depth expertise in SAP FICO and

prepare you for a successful career in finance and accounting.

Gain a competitive edge with the SAP FICO S/4HANA training program. Master core and advanced financial accounting and controlling concepts tailored for the S/4HANA environment. Explore real-time financial scenarios and leverage SAP best practices to streamline financial operations, ensure regulatory compliance, and improve reporting accuracy. This hands-on training empowers you to manage end-to-end financial processes, enabling strategic decision-making and driving digital transformation in modern enterprise finance.

Get the real classroom experience. Interact with learners and engage with mentors in real-time via Slack.

Missed a class? Access recordings to always maintain learning progress and keep up with your cohort.

Expert guidance sessions from mentors for doubt clarifications, project assistance, and learning support.

Get a dedicated Cohort Manager for all your queries and help you succeed at every learning step.

This Applied Generative AI course equips you to develop AI-powered applications using industry-relevant tools and frameworks. Master key concepts like prompt engineering, GANs, VAEs, and LLM architectures while exploring advanced topics, including agentic AI, LLM fine-tuning, RAG, and AI governance for practical, real-world deployments.

+91-9948444808

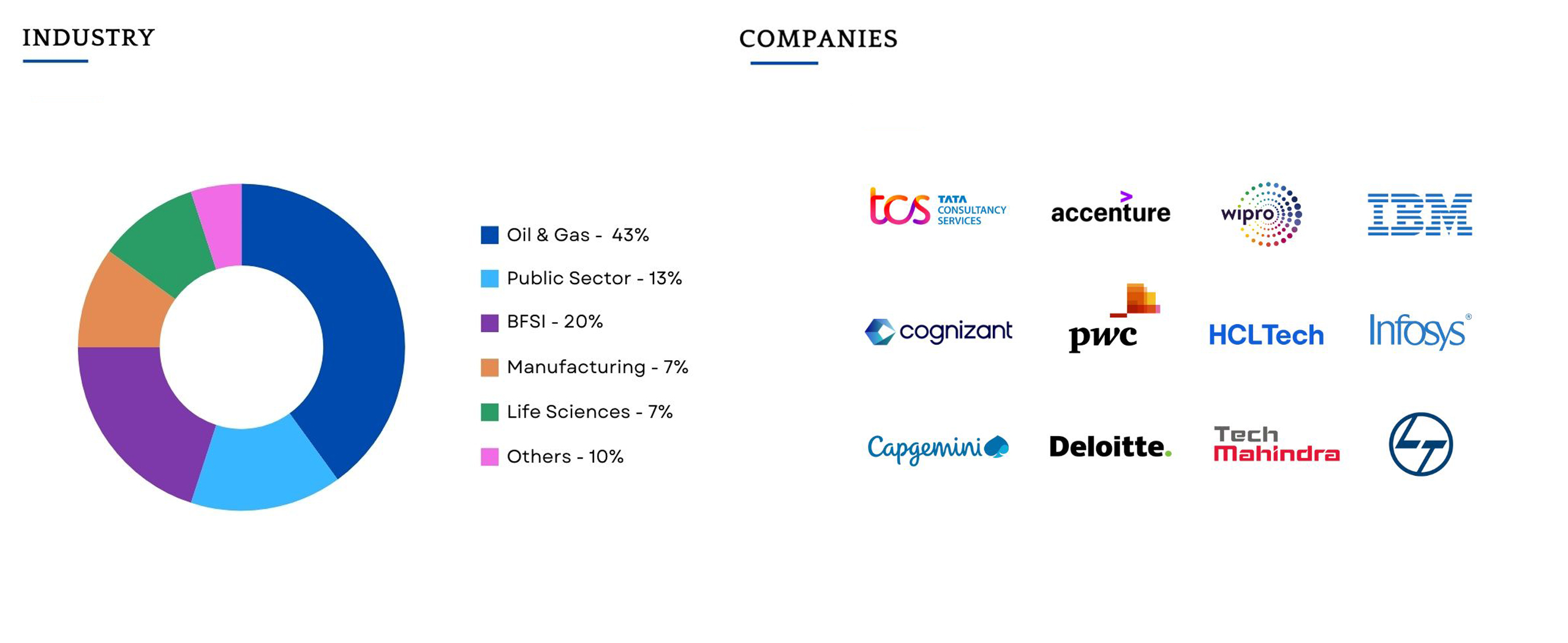

This program caters to working professionals from a variety of industries and backgrounds; the diversity of our students adds richness to class discussions and interactions.

The Gen AI module was an eye opener for me. The mentor’s teaching style in the weekend sessions was spot on. While there’s a lot of Gen AI content online, this module stood out for its structured approach and the mentor’s interactive guidance. It made learning about AI easy, even for beginners like me.

Lead Consultant

The SAP FICO training was a game-changer for my career. The course was well-structured, and the trainer made complex topics easy to understand. I landed a job within a month of completing the course!

You will never miss a lecture at Emax You can choose either of the option: View the recorded session of the class available in your LMS.

Your access to the Support Team is for lifetime and will be available 24/7. The team will help you in resolving queries, during and after the course.

Post-enrolment, the LMS access will be instantly provided to you and will be available for lifetime. You will be able to access the complete set of previous class recordings, PPTs, PDFs, assignments. Moreover the access to our 24×7 support team will be granted instantly as well. You can start learning right away.

Yes, the access to the course material will be available for lifetime once you have enrolled into the course.

Copyright © 2025 Emax Technologies | All Rights Reserved. Designed by Web Rocz.

SAP® is a registered trademark of SAP SE in Germany and in several other countries. All SAP modules, including but not limited to SAP FI (Financial Accounting), SAP MM (Materials Management), SAP SD (Sales and Distribution), SAP HR (Human Resources), SAP FICO (Financial Accounting and Controlling), SAP PP (Production Planning), and others, are proprietary products of SAP SE.

This website provides educational resources related to SAP® modules, including descriptions of functionalities and their applications. However, [Your Company Name] is in no way associated, sponsored, or endorsed by SAP SE, and it does not offer SAP® official training, courses, or certifications unless explicitly mentioned.

All other product names, logos, and trademarks mentioned on this website, such as SAP S/4HANA, SAP Ariba, SAP SuccessFactors, SAP C/4HANA, SAP BusinessObjects, SAP BW, and SAP Analytics Cloud, are trademarks or registered trademarks of SAP SE and its affiliates.

ITIL®, PRINCE2®, MSP®, Scrum certifications, and other referenced frameworks or certifications mentioned are the respective trademarks of AXELOS Limited, Scrum Alliance, Scrum.org, and other industry organizations.

The use of SAP® product names and trademarks here is solely for educational purposes, and no claims of affiliation or endorsement by SAP SE are implied. For official SAP® training, support, and certification, please consult authorized SAP® providers or partners.

SAP® is a registered trademark of SAP SE in Germany and in several other countries. All SAP modules, including but not limited to SAP FI , SAP MM , SAP SD , SAP HR , SAP FICO , SAP PP , and others, are proprietary products of SAP SE.